At SealedBid Marketing, we are actively entrenched in the lower mid-market M&A transaction space and we closely monitor valuation across many industries. The SealedBid team routinely meets and consults with business owners and their Deal Team advisors regarding Succession Planning and Exit Planning as well as valuation expectations. “How much is my business worth?” is an important, if not the first, question on every owner’s mind and through this Spotlight we explore several high-level example scenarios that will help to define valuation expectations.

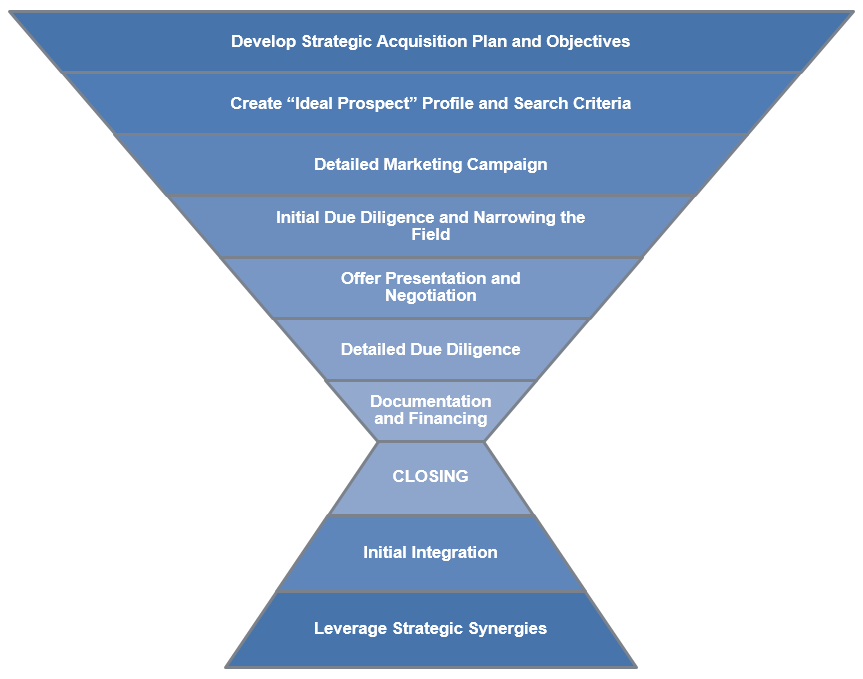

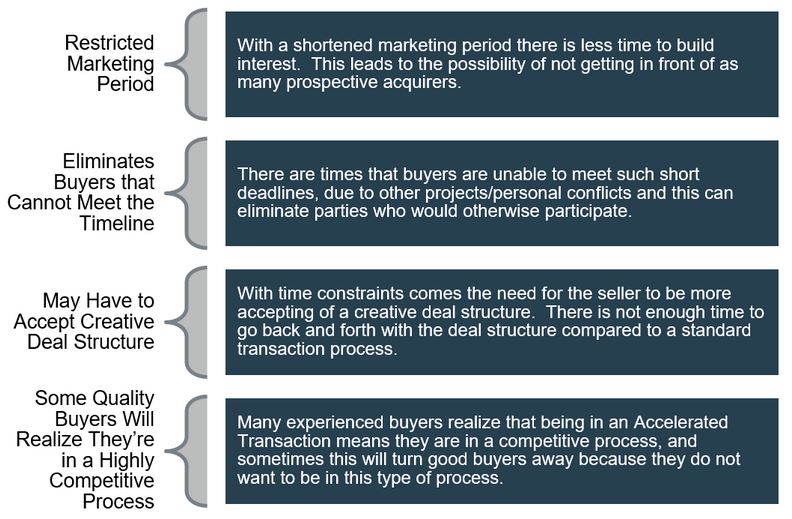

There are many factors that can affect valuation. Certified Business Appraisers use several methods (outlined below) when completing their analysis for estate and banking purposes, but determining Market Valuation, when the business is truly put up for sale, is both an art and a science. Creating a competitive process through a Structured Marketing Campaign and targeting different prospective buyer types will bring a variety of valuations/structures and will ultimately maximize and determine the true enterprise value!

Valuation: The Textbook Definition

A valuation is the process of figuring out a fair market value of a company. In addition to selling/buying a business, there are numerous other situations where a valuation could be required, including; reorganizations, shareholder disputes, estate planning, etc. The method of valuation can vary by each situation, however the goal is the same: determine a present value, in today’s market, for an operating business.

Market Approach: For this approach, a valuator/appraiser decides the fair market value of the company by researching actual business transactions that are similar to the company they are trying to valuate. It is important that the valuator finds companies that are of similar size to the target company since a company’s value can change drastically depending on the revenue/EBITDA of that company.

Asset Approach: The asset approach is when the company’s current value of tangible net assets is used as the main decision maker of fair market value. The Asset Approach is more common when a business is no longer operating as a going concern and/or the liquidation of the assets creates more value than the profitability of the business. Additionally, reviewing the value of the assets can impact financing availability and other valuation considerations.

Income Approach: The income approach is commonly used when valuing private small to medium-sized businesses. This approach uses a company’s revenue and profitability to determine a valuation. There are multiple ways to model the Income Approach such as Multiple of Discretionary Earnings, Discounted Cash Flows, and a Multiple of Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”). Regardless of the Income method used, the valuation is a result of a predetermined or desired Return on Investment of the buyer based on today’s and future cashflow of the business. Businesses showing strong trends, stability and limited risk receive higher multiples.

Note: At SealedBid, we primarily see prospective buyers using a Multiple of recast EBITDA. Applicable recast adjustments made to EBITDA, or the removal or normalization of extraordinary expenses, will vary depending on the buyer, making it extremely important to understand an Owner’s ultimate goals and all potential prospects.

Different Types of Buyers

Not only are there multiple different valuation approaches, but there are also numerous different types of buyers that will all approach valuation for the same company differently.

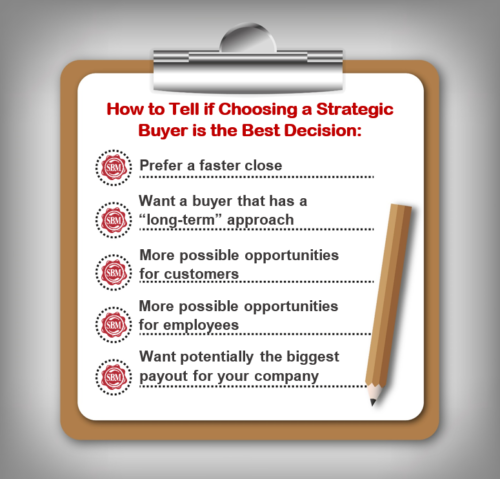

Strategic: A strategic buyer is an operating Company with existing knowledge and/or expertise in the target company’s market or industry. This could be a competitor, vendor, customer or simply a company within the same vertical industry looking to expand offerings. Unlike a financial buyer, a strategic buyer will focus on finding a company that adds immediate benefits to its existing business and can provide synergistic opportunities, i.e. a one plus one equals three scenario. Because of these potential synergies, a strategic acquirer will model the valuation differently and could potentially bring a higher valuation for a company. The tradeoff of pursuing these synergies and realizing a higher valuation means there is a potential for the Seller’s business to be moved, consolidated, renamed or changed in other ways.

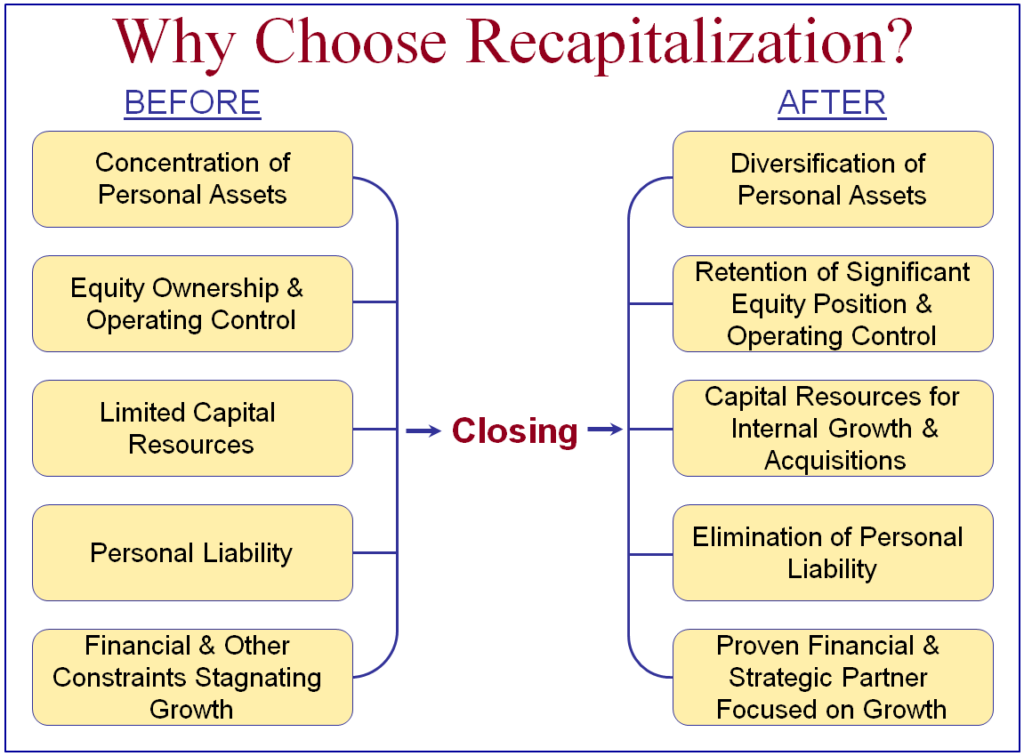

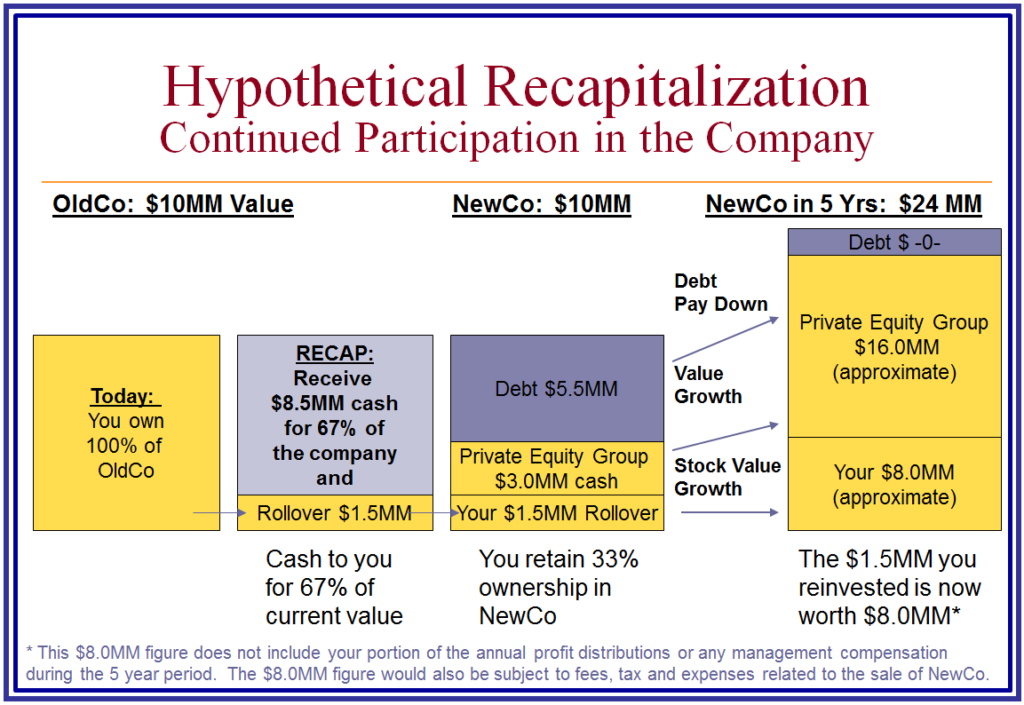

Financial: A financial buyer is a buyer that invests in private or public companies on behalf of a larger shareholder/investor group. Once acquired, a financial buyer will work to improve the company’s operational and financial performance over a certain period of time and eventually sell the business to create returns for its investors. Financial buyers are generally private equity firms, investment funds, family offices, etc. that offer a wide variety of options for business owners from a complete exit to reinvestment. When there is a strong owner and management team of a company, a supportive financial buyer can help the company grow by various recapitalization scenarios.

Individual or Small Group: An individual or small group buyer typically focuses on acquiring a single business with the intent of owning/operating the business going forward. Typical individual buyers include professionals who are transitioning from the corporate space. Although these buyers are not always the most sophisticated, they do create many benefits to a seller including maintaining the Company’s existing name, location, employees, etc.

Important Note: There are positives and negatives to each type of buyer and understanding the Ownerships’ goals is key to facilitating the ideal transaction. Strategic, financial and individual buyers will approach each transaction with varying equity/debt resources, expertise and post-close expectations.

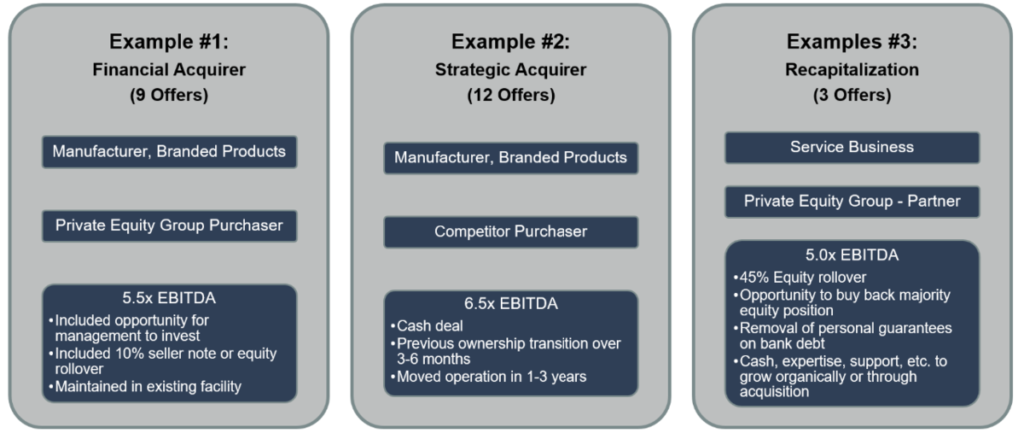

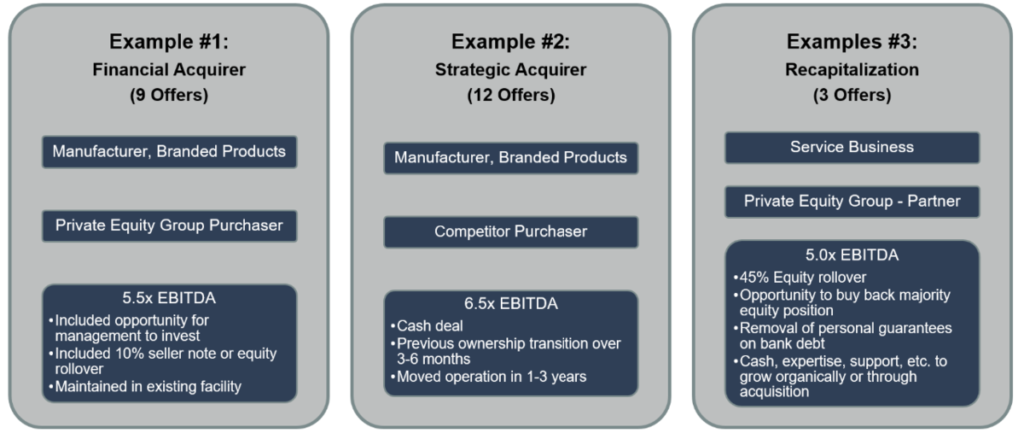

Transaction and Valuation Examples

Below are three real example transactions, along with their approximate valuation. Since each transaction is so unique, it is difficult to pin point exact multiples (by industry, etc.), but these examples give an idea of different structures/valuations. At SealedBid, we never go to market with an asking price and have closed transactions with valuations above 8x EBITDA!!!

Certified Business Appraisals and analyzing valuation techniques will provide insight into a specific business’s value, but to truly know what the Company will bring requires going to market and successfully reaching the ideal buyers!

SealedBid’s Role in Market Valuations

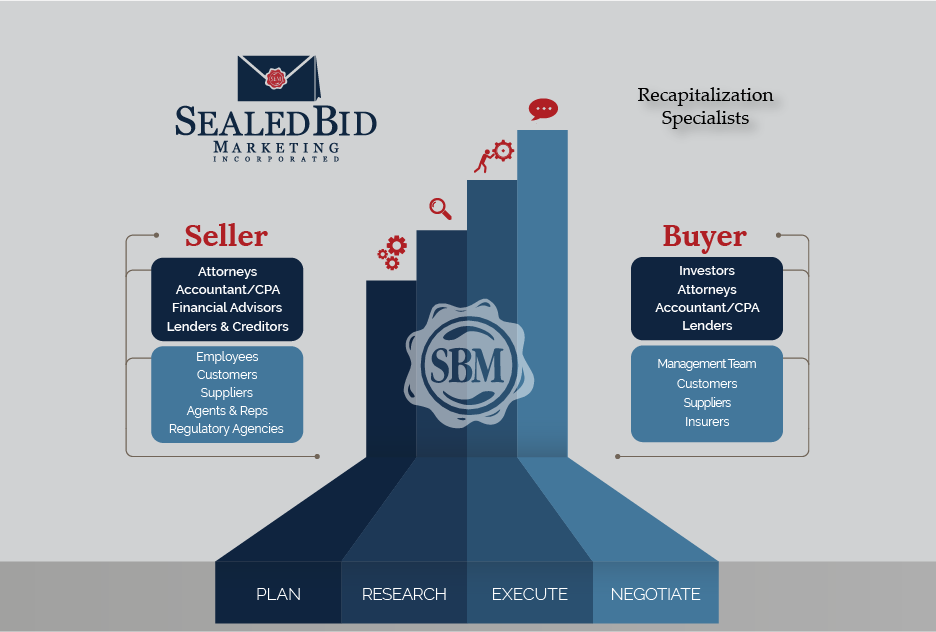

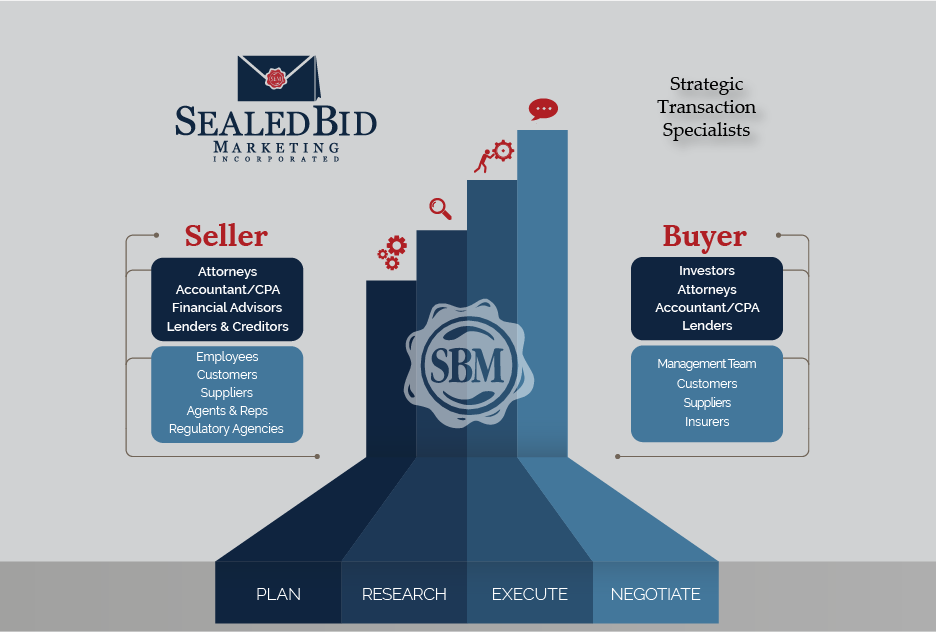

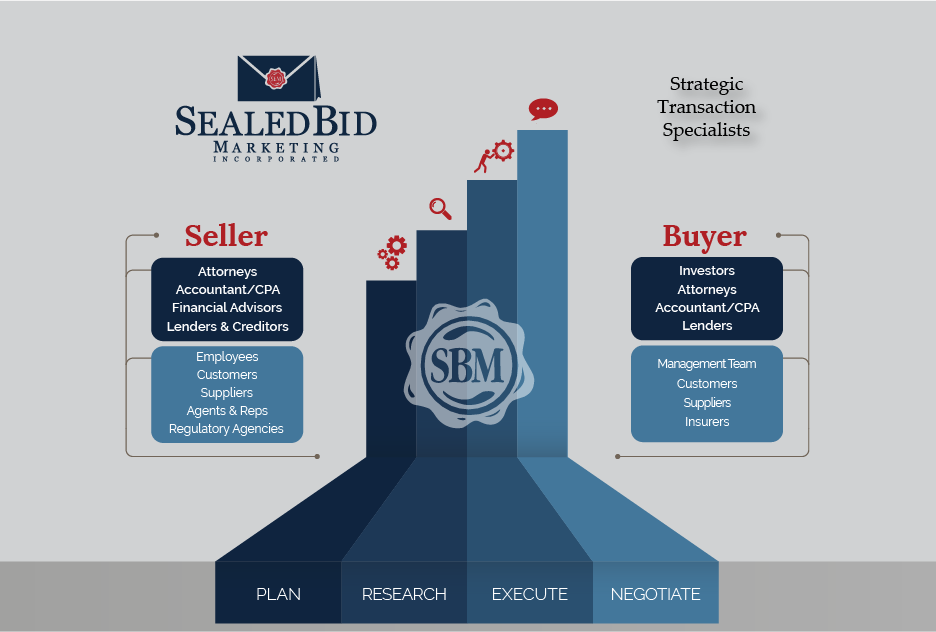

SealedBid is proud to have successfully served clients for over 25 years by providing Sell-Side and Buy-Side M&A Advisory, Recapitalizations, Succession/Exit Planning, Family Transfers and Management/Partner Buy-outs. As a boutique firm, SealedBid engages in a limited number of projects at any given time to ensure we deliver the highest level of senior attention, expert advice and transaction experience to each client.

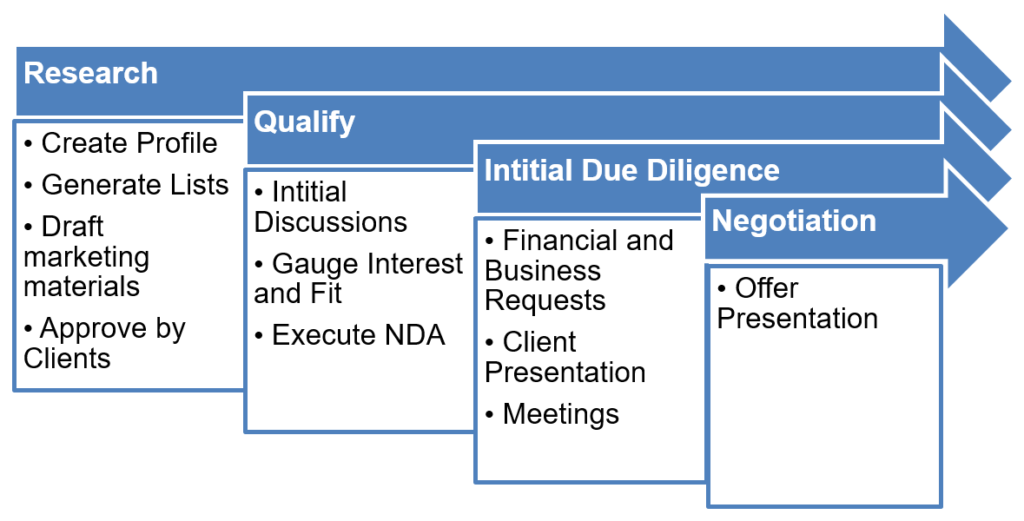

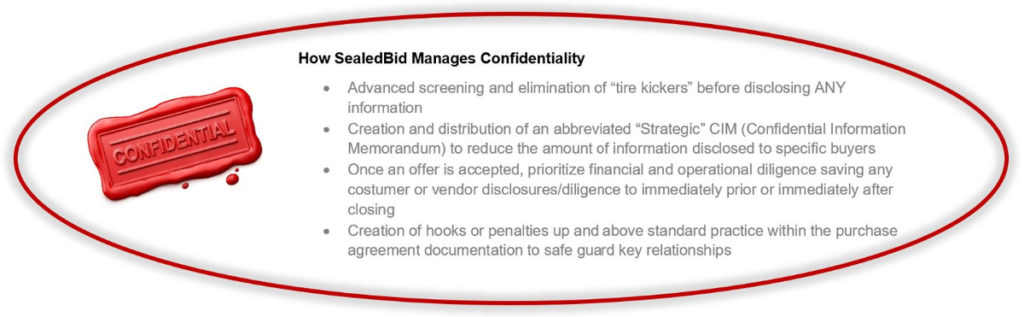

SealedBid works to understand our clients’ goals and identify, contact and engage ideal prospective acquirers, and create a go-to-market strategy that will maximize enterprise value. Although we NEVER market a business with an asking price, we will conduct preliminary financial analysis and provide valuation guidance.

If you are interested in learning more about SealedBid, our services or our team, please do not hesitate to contact us at (952) 893-0232. SealedBid will work closely with you, your financial advisor, attorney, accountant and banker from the initial stages of pre-marketing through closing and post-closing.