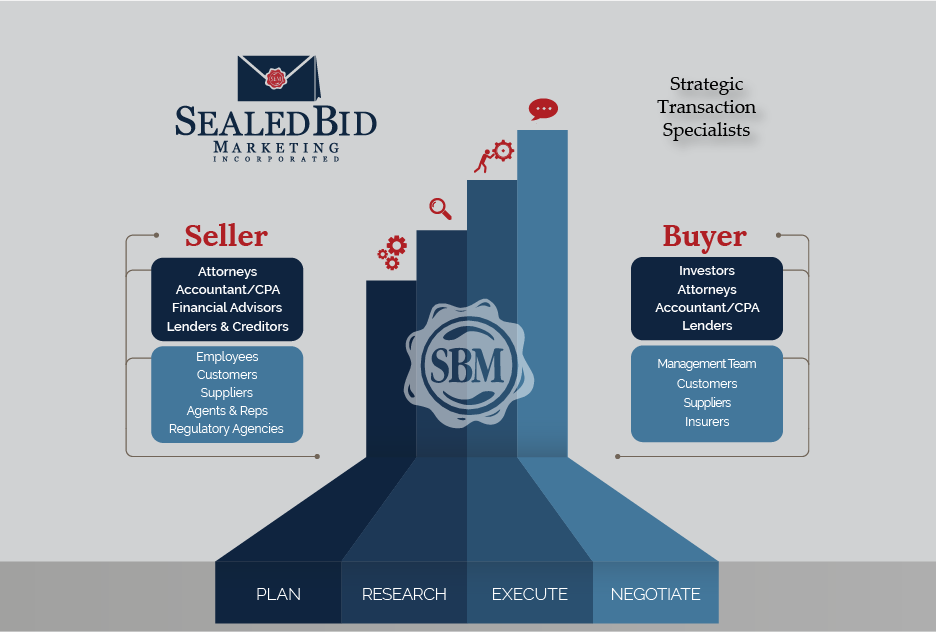

SealedBid is known for assisting private, lower mid-market business owners as a Sell-Side advisor/intermediary because of our expertise in Strategic Acquisitions (Roll-ups/Fold-ins), Financial Acquisitions (Private Equity), Corporate Divestitures and Recapitalizations. But for companies looking to GROW THROUGH ACQUISITION, SealedBid also offers and has had tremendous success as a Buy-Side advisor/intermediary.

Strategic Growth Through Acquisition

Along with the traditional efforts to produce organic growth (e.g. adding products/services, increasing or improving marketing/sales and adding strong employees/management to your team), businesses often reach “the-next-level” or “cross-the-chasm” through acquisition. Growth through acquisition can be less expensive, faster and even sometimes less risky than allowing for stagnation or slow organic growth.

When a company is looking to complete an acquisition, there are many different strategies to evaluate, including but not limited to:

Channel Expansion: Acquiring a company that has complimentary products or services is a great way to grow your company. There are many times that a company wants to enter these new channels and has trouble figuring out how to do so. Choosing this path of acquisition is an easier way to enter a similar, but different market. Being able to pair your company’s current products and/or services with the new company’s products and/or services is a huge win.

Geographic Expansion: Companies looking to access new markets, obtain manufacturing and distribution efficiencies and/or better service existing clients can immediately benefit from acquiring strategic companies outside their existing geographic territory.

Market Consolidation: Acquiring a company that is very similar to your company. Adding a similar company allows for instant market growth and impact. Some companies may even consider acquiring more than one company similar to their company so that they have even more power in their market.

In a perfect world, a strategic acquisition creates a 1+1=3 (or sometimes a lot more!) scenario for all parties due to newly leveraged synergies and relationships (e.g. customers, distributors, channels, suppliers, etc.)

The process of identifying the right type of company to acquire, approaching like companies, engaging in negotiations and completing an acquisition takes energy and expertise.

Buy-Side M&A Process

After Confirming that your Decision to Make an Acquisition is the Best Option, Securing Buy-Side Representation is a Practical Next Step

Role of a Buy-Side Advisor/Intermediary

- To help a company identify, filter and reach out to prospective acquisition targets in a professional and confidential manner

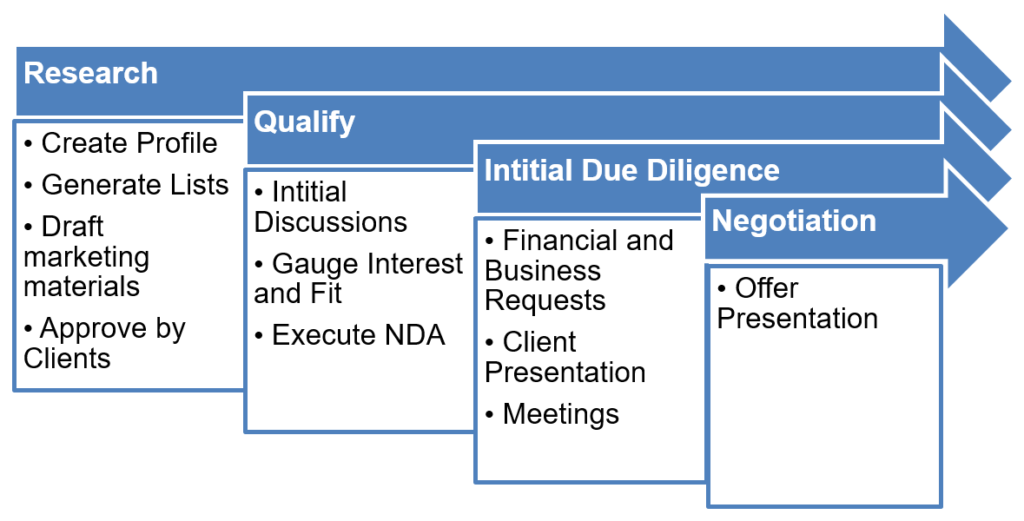

- Assist with prospect research, initial due diligence/information collection and prospect screening

- Help the company evaluate the benefits and possible challenges of acquiring the identified prospective targets

- Set prospect expectations, assist with negotiations and provide a buffer for the client company in case of tenuous negotiations

- Assist attorneys, CPAs and leadership teams in any final due diligence items and closing the deal

Importance (VALUE) of a Buy-Side Advisor

- Not only does a Buy-Side advisor/intermediary help search for prospective targets, but they can also expand the Buy-Side search beyond what a company can do on their own. M&A firms are well connected to a network of potential sellers and can use additional resources to work with their Buy-Side client.

- A Buy-Side advisor/intermediary can help create a more defined offer that will get the best deal for the buyer. There are many times during a negotiation process that the buyer and seller will not see eye to eye; however, an M&A firm Buy-Side advisor/intermediary can help get through these difficult situations, leading to a quicker, smoother process.

- A Buy-Side advisor/intermediary will help a company reach the finish line. From due diligence to coordinating meetings, having a Buy-Side advisor/intermediary takes a lot of the stress and pressure off the buyer.

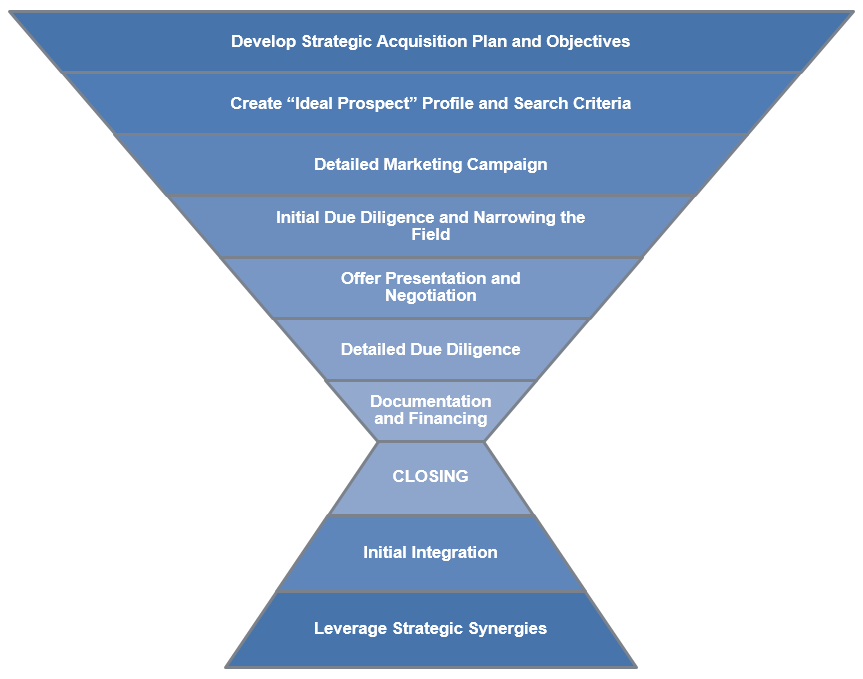

Buy-Side Prospect Funnel

SealedBid’s Role in Buy-Side Advisory

SealedBid is proud to have successfully served clients for over 25 years with M&A Advisory, Recapitalizations, Succession/Exit Planning, Family Transfers and Management/Partner Buy-outs. As a boutique firm, SealedBid engages in a limited number of projects at any given time to ensure we deliver the highest level of senior attention, expert advice and transaction experience to each client.

Our Transaction Professionals are experienced at sourcing “ideal prospects”, identifying sellers, negotiating and completing Buy-Side transactions. In closing…remember that an M&A advisor/intermediary is not only beneficial in a Sell-Side transaction, but can add huge value to a Buy-Side acquisition strategy.

If you are interested in learning more about SealedBid, our services or our team, please do not hesitate to contact us at (952) 893-0232. SealedBid will work closely with you, your financial advisor, attorney, accountant and banker from the initial stages of pre-marketing through closing and post-closing.