What Does Selling to a Strategic Buyer Mean?

When marketing a company for sale, one must consider all types of prospective buyers. There are two primary categories of buyers – strategic and financial. Our Maximizing Value Spotlight expounds upon the “Different Types of Buyers” but it is important to clearly define each category:

Strategic: A strategic buyer is an operating Company with existing knowledge and/or expertise in the target company’s market or industry. This could be a competitor, vendor, customer or simply a company within the same vertical industry looking to expand offerings. Unlike a financial buyer, a strategic buyer will focus on finding a company that adds immediate benefits to its existing business and can provide synergistic opportunities, i.e. a one plus one equals three scenario.

Financial: A financial buyer is a buyer that invests in private or public companies on behalf of a larger shareholder/investor group. Once acquired, a financial buyer will work to improve the company’s operational and financial performance over a certain period of time and eventually sell the business to create returns for its investors. Financial buyers are generally private equity firms, investment funds, family offices, etc. that offer a wide variety of options for business owners from a reinvestment to a complete exit. When there is a strong owner and/or management team of a company, a supportive financial buyer can help the company grow by various Recapitalization scenarios.

Note: Financial buyers with existing holdings or portfolio companies can very easily become a Strategic Acquirer as they look to complete add-on transactions and grow through M&A.

Strategic Buyer Industry Snapshot

According to Pepperdine’s “2019 Private Capital Markets Report”:

- About 55% of closed business sales transactions over the last 12 months involved strategic buyers.

- About 39% of the 92 respondents to the investment banker survey indicated that there was an increasing presence of strategic buyers making deals over the last 12 months.

- About 21% of respondents did not see any premium paid by strategic buyers, while 56% saw premiums between 1% and 20%. The remaining 23% saw premiums more than 20%.

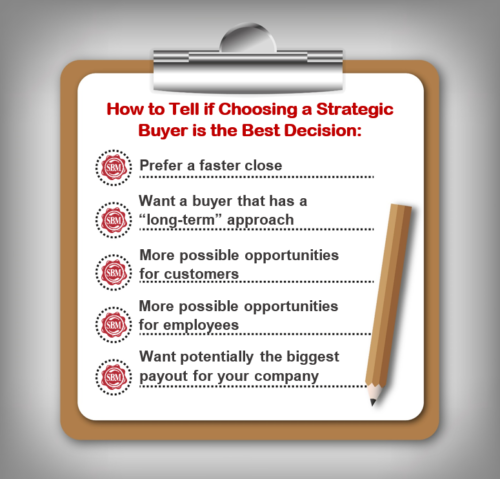

Pros of Selling to a Strategic Buyer

Selling to a strategic buyer creates many advantages for ownership and the company as a whole.

- Possibility of a Higher Valuation: An operating company looking to grow through acquisition(s) may look beyond a seller’s profitability when preparing their valuation. Often Strategic Buyers are quick to identify synergies that could immediately enhance the target business and/or their own existing business. Example synergies include expanded customer reach, new vendor relationships, capability expansion, product cross-selling and improved market share among many others. In the article “Should You Sell to a Strategic Buyer?” JP Morgan states, “buyers are often willing to pay more than the accepted ‘going rate’ for companies in whose data, products or processes they have a vested interest.” The objective of SealedBid when marketing to Strategic Buyers is to highlight these synergies and provide accurate information to improve a respective buyers model.

- New Opportunities for the Company’s Stakeholders: In the lower mid-market, strategic acquisitions almost always create exciting opportunities for Employees, Customers and Vendors. When an acquirer begins with the mindset of growth, existing employees, especially the key management team, are relied upon to both plan and execute the strategy for capturing/realizing the identified synergies between the businesses. Employees also find themselves a part of a larger organization, which includes additional resources, career advancement opportunities and benefits that did not exist pre-transaction. Customers and Vendors often experience similar benefits through increased resources and support.

- Streamlined Due Diligence & Closing: There is a higher likelihood that a transaction with a Strategic Buyer will close and that diligence efforts may be less intensive. Due to the acquirers existing knowledge of the industry as well as their focus on specific synergistic elements, the diligence team will move quickly to verify their expectations without the hurdles that exist for a buyer who is completely new to the space. Additionally, transaction funding or financing relationships are likely to be already in place making the closing process less complicated than other ownership-transition options.

- Reduced Ownership Transition: Often business owners and entrepreneurs culminate their professional careers with a transaction and are anxious to retire or pursue other personal or professional ventures outside of the business they’ve built. The transition of knowledge, relationships and responsibilities is an absolutely necessary part of the Succession Planning process and this can often take years and depending on the situation, this transition may be required post-transaction. A Strategic Buyer with intimate knowledge of the industry often has an experienced team in place that can greatly reduce or eliminate the learning curve and transition period.

- Long Term Vision / No “Flipping”: Strategic acquirers use M&A to supplement organic growth and quickly work to fold the acquired company into their operation. This is in stark contrast to financial acquirers who typically have a 3 to 7-year investment horizon before the company/team must undergo another transaction.

Cons of Selling to a Strategic Buyer

Although there are many positive reasons for choosing a strategic buyer, there are risks and cautions that must be taken when considering a Strategic Buyer.

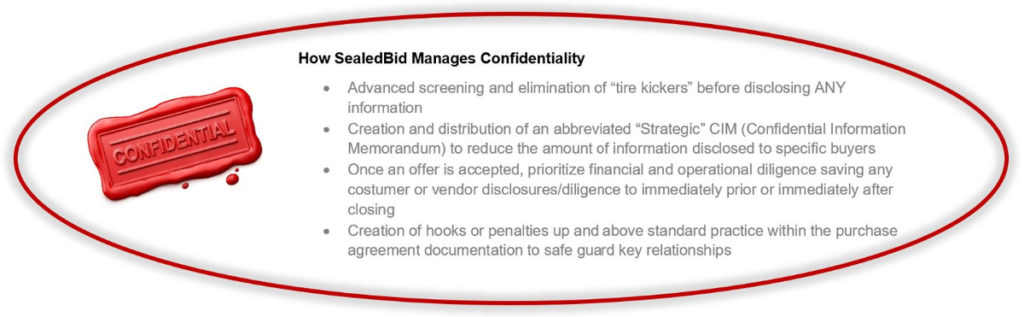

- Confidentiality & Trade Secrets: Despite the execution of Non-Disclosure and Confidentiality Agreements by all parties, there remains understandable concern when disclosing information to a competitor, customer or any industry player. The challenge is to disclose enough for a prospective acquirer to make an educated, valid offer without giving away any “secret sauce.”

- Role Duplication: With the merging of two similar companies, there can be role duplication that leads to adjustments in the organizational chart. This truly is a case by case basis for each scenario, but the most common duplication is in the finance, HR and payroll areas of the company.

- Company and Brand Legacy: In some cases, synergies that create higher valuations also come with reduced expenses such as the consolidation of operations or the roll-up of a product portfolio. Business owners and entrepreneurs who have spent years building a connection to their community and a reputation within the industry may not feel comfortable moving forward with an acquirer who would make sweeping changes.

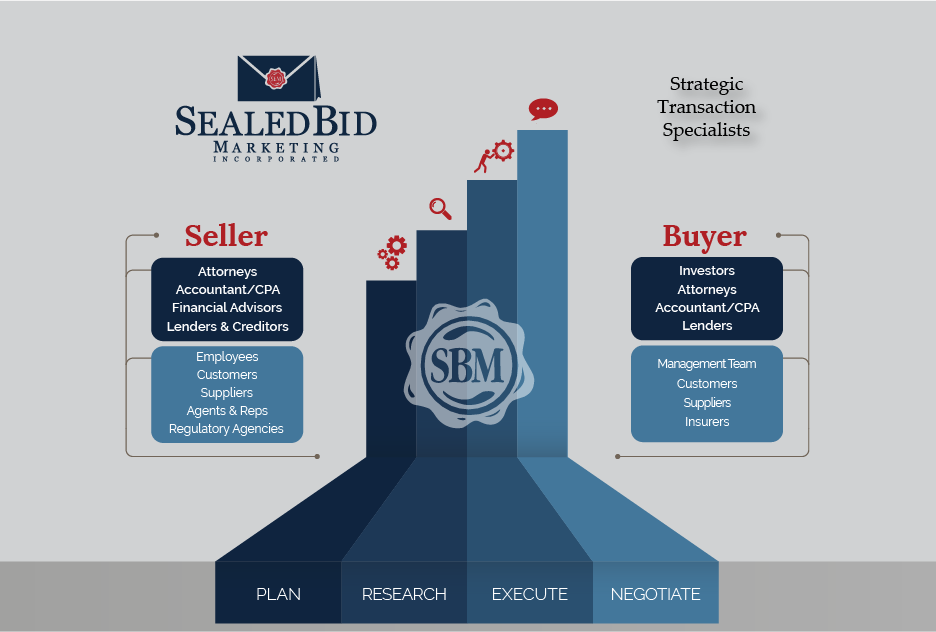

SealedBid’s Role in Selling to a Strategic

SealedBid uses a Structured Transaction Process to identify and directly solicit potential Strategic Buyers. We work closely with our clients to understand the most important issues/concerns they have with competitors, customers, vendors and other industry players and then work to ensure those issues/concerns are addressed early on in the process. SealedBid coaches prospective acquirers based on our client’s ideal transaction and scenario all while working to Maximize Value. SealedBid is the buffer between sellers and prospective acquirers, and we help manage information disclosure, timelines and ultimately the entire transaction process.

Example “Selling to a Strategic” Successes

SealedBid is proud to have successfully served clients for over 25 years by providing Sell-Side and Buy-Side M&A Advisory, Recapitalizations, Succession/Exit Planning, Family Transfers and Management/Partner Buy-outs. As a boutique firm, SealedBid engages in a limited number of projects at any given time to ensure we deliver the highest level of senior attention, expert advice and transaction experience to each client.

SealedBid works to understand our clients’ goals and identify, contact and engage ideal prospective acquirers, and create a go-to-market strategy that will maximize enterprise value. Although we NEVER market a business with an asking price, we will conduct preliminary financial analysis and provide valuation guidance.

If you are interested in learning more about SealedBid, our services or our team, please do not hesitate to contact us at (952) 893-0232. SealedBid will work closely with you, your financial advisor, attorney, accountant and banker from the initial stages of pre-marketing through closing and post-closing.