Many business owners are seeing the benefit of Recapitalizations as opposed to a complete sale of their businesses. Would you like to…

- Remove personal guarantees with the bank and capture partial liquidity?

- Expand geographically, increase production or acquire another company?

- Participate in future success of the Company?

If you answered yes to any of these questions…a Recapitalization or “Recap” may be the right solution for your business!

What is a Recapitalization?

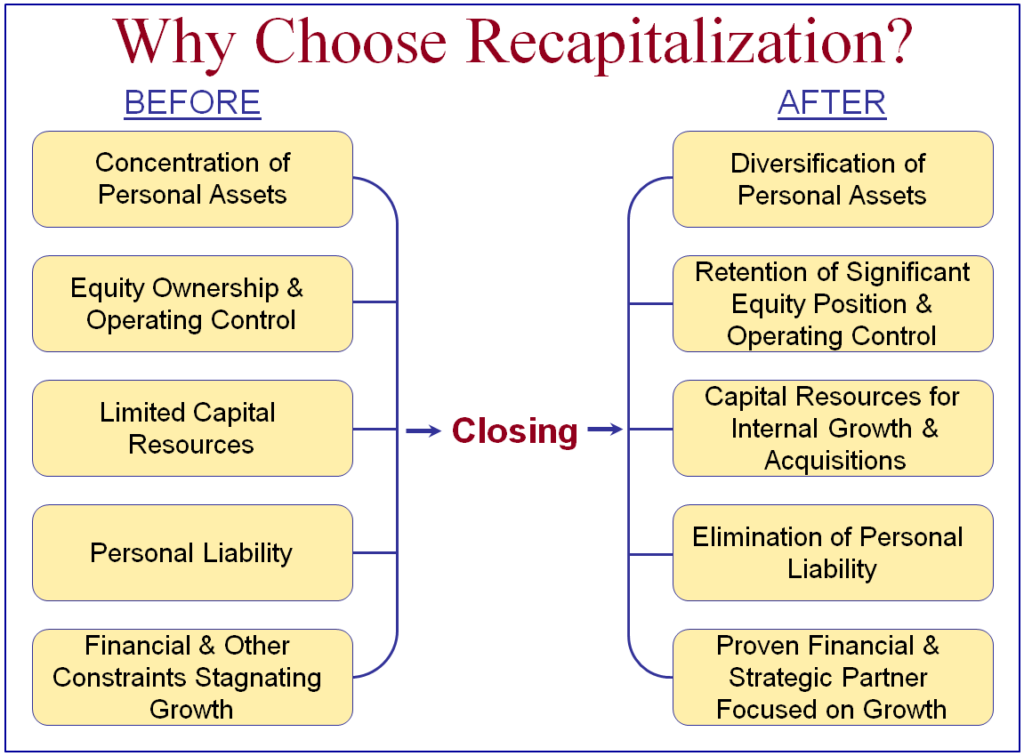

A Recapitalization provides business owners a “private liquidity event” similar to an initial public offering, which provides owners with a public liquidity event. In a Recapitalization, a Private Equity Group (PEG) or Financial Buyer acquires an interest of a company from the owners, while partnering with them to continue the development of the company through internal growth initiatives and potential acquisitions.

How does Recapitalization Work?

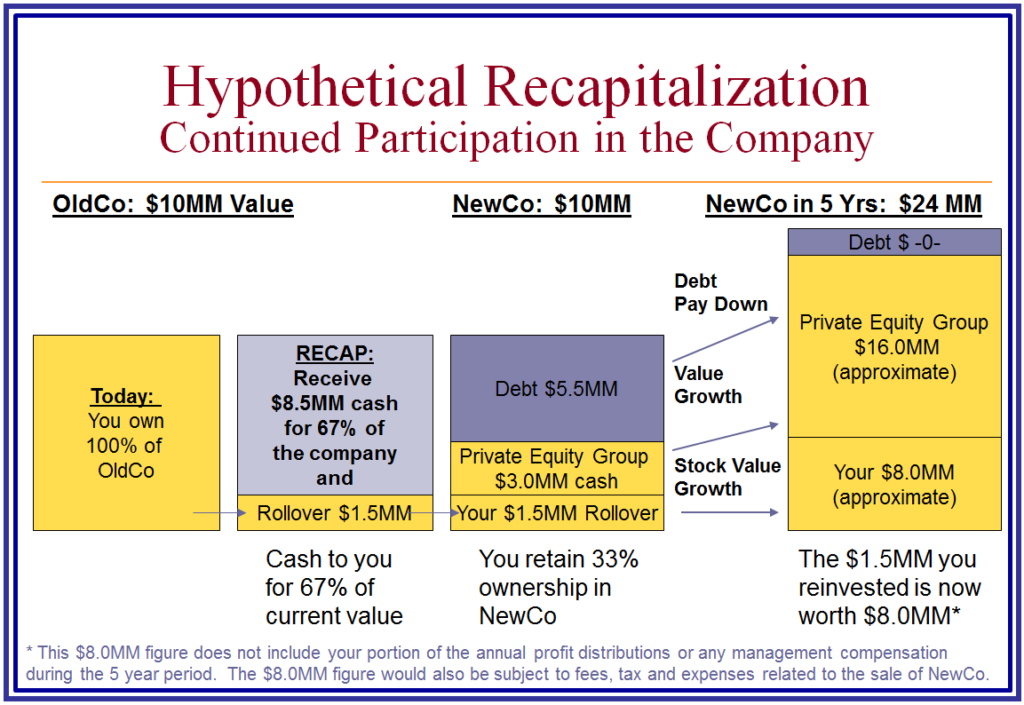

A Recapitalization involves exchanging the owner’s equity for a combination of cash and a piece of the capital stock of new entity. A Recapitalization is designed to support the company as it continues, as well as future growth. This allows the owners to receive a monetary gain while staying involved in the future potential of the company.

Are You a Good “Recap” Candidate?

Private Equity Investors (PEG) and Financial Buyers look for companies that have defined growth plans, consistent earnings or growth, significant market share or a niche position and experienced management teams.

What Should You Look for in a PEG or Financial Buyer?

When looking at potential buyers, consider the investor’s experience in your industry, their reputation among other management teams for integrity and delivering on promises and value they can add to your operations. In addition, could you still operate independently if you decide to remain at the company, will they provide capital to support growth and will the transaction close in a timely fashion?

Example Transaction:

Terry is the owner of “OldCo” but decides that capital is needed to grow the business, so a decision to recapitalize is made. Terry partners with SealedBid to facilitate a relationship with a financial buyer or PEG. With an exchange of ownership, “OldCo” becomes “NewCo” and Terry no longer has majority shares of the business. But Terry still benefits from “NewCo’s” future growth in value and realizes an opportunity to benefit again at some point in the future when the decision is made to sell his/her remaining interest in the company.

Prepared by SBM. All statements and figures presented herein are for example purposes only and are not guaranteed.

Prepared by SBM. All statements and figures presented herein are for example purposes only and are not guaranteed.

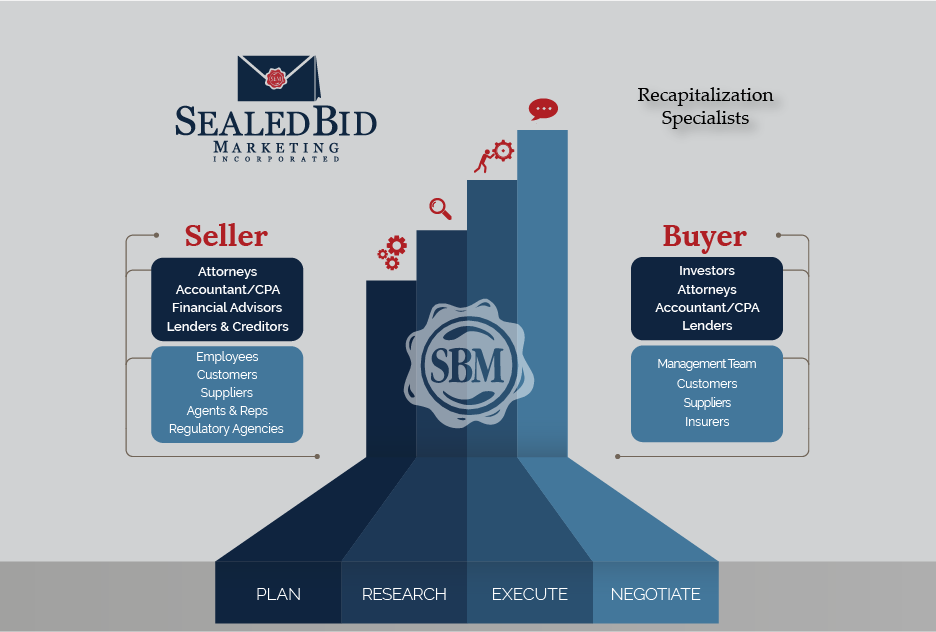

Intermediary’s Role in a Recapitalization

- SealedBid will assist in determining the business value range as well as identify and qualify prospective buyers (i.e. PEGs).

- SealedBid will create, coordinate and execute marketing plans to position the company.

- SealedBid will also negotiate on your behalf with multiple prospective buyers.

- SealedBid will oversee the due diligence process, making sure progress stays in line with the timeline that was initially established.

- Finally, SealedBid will manage the closing process until the very last signature! Including any post-closing issues…

If you are interested in learning more about SealedBid, our services or our team, please do not hesitate to contact us at (952) 893-0232. SealedBid will work closely with you, your financial advisor, attorney, accountant and banker from the initial stages of pre-marketing through closing and post-closing.