In special situations, SealedBid offers business owners an Accelerated M&A process that allows a quick exit and the ability to obtain financial relief through a structured transaction process.

Distressed Situations

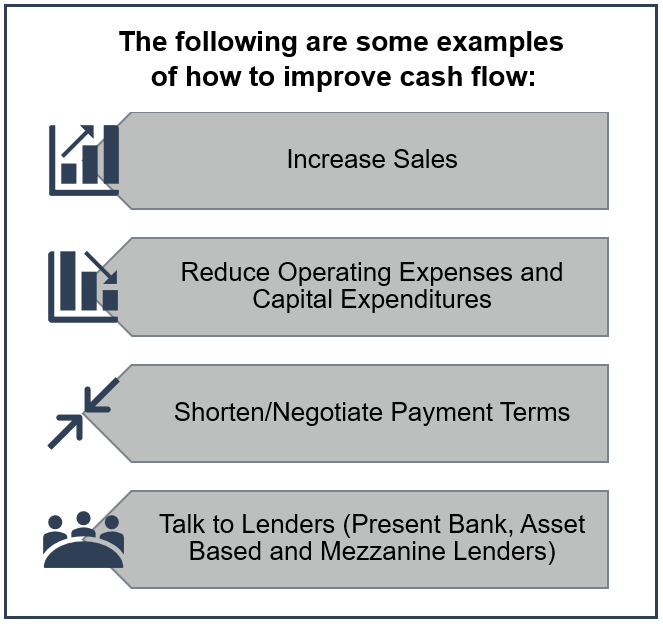

Negative Cash Flow: When a company is spending more money than they are making during a specific period. In most instances, negative cash flow means that your company is losing money. However, in other instances, negative cash flow can reflect bad timing of income, expenses or capital expenditures. It is possible to have a net profit and have a negative cash flow. If there is continuous, long-term negative cash flow this can be very harmful to businesses.

Creditor Pressure: When a Company receives pressure from creditors it is a clear sign that there is financial distress. One example of why creditors may start pressuring a company is because the company is in arrears or default (they are failing to pay financial obligations in a timely manner). Another reason is if a company breaks a loan/bank covenant (a clause in a loan agreement that requires the borrower to do/refrain from doing specific things).

Avenues of Relief for a Financially Distressed Company

Turnaround Management/Workout Consulting: A company that is having financial issues and/or failing performance can hire a turnaround management/workout consulting company to help correct these issues. A turnaround management company will identify the root issues and then help create a long-term strategic plan. A workout consultant will help create a strategy to negotiate with lenders and creditors in order to restructure any debt.

Asset Based Lending/Factoring/Alternative Financing: Another option for a financially troubled company is asset-based lending. Asset-based lending is lending secured by primary current assets or fixed assets. Companies that are asset-heavy may find this is a good option. Choosing a factor is also an option. A factor is an intermediary that provides cash or financing to companies by purchasing their accounts receivables. This helps improve a company’s short-term cash needs. It is important to note that a percentage of the receivables is typically kept by the factor. Lastly, there are many alternative financing (non-bank financing) options such as online business loans, crowdfunding and merchant cash advances.

Chapter 11 Bankruptcy: Filing Chapter 11 bankruptcy protection is typically a last resort. A business usually files for Chapter 11 bankruptcy protection if they require time to restructure their debts. This type of bankruptcy gives the debtor/company immediate protection from creditors. Chapter 11 bankruptcy is also known as “reorganization” and can subsequently result in an Accelerated Transaction* through a 363 sale. A 363 Sale refers to the sale of a company’s assets under Section 363 of the US Bankruptcy Code. The sale allows debtors to fulfill their obligations to creditors by selling their assets and using the funds collected to settle their debts.

*An Accelerated Transaction process: Companies in financial distress often need to move quickly. Although an accelerated transaction process may sometimes yield a lower selling price, this is not always the case.

Unique Aspects with a Financially Distressed Transaction

When it comes to the M&A transaction process of a selling a Financially Distressed Transaction, there are many differences compared to a standard M&A process.

Reduced Timeframe: Usually the negotiation timeline will be accelerated due to the worsening financial situation of the target, creditor demands and the potential near-term loss of significant business relationships (customers, employees, suppliers, etc.).

Due Diligence Challenges: Specific pressures will adapt a normal due diligence process in a financially distressed M&A transaction.

Risk of Challenge/Litigation: A financially distressed company usually leads to a depressed valuation. In the context of an M&A deal, lenders, other creditors and/or equity holders may not receive full value on their debts or investments. Because of this, a buyer faces the risk that the sale process or the terms of the sale will be challenged by equity holders, creditors or trustees, either during the sale process or after closing. Through structure and drafting, these risks can be reduced, but not eliminated.

More Parties Involved: In addition to the usual buyer/seller negotiations, there is more need to coordinate with lenders, lien holders, landlords, suppliers, customers, management teams, etc. so that the acquired business remains viable post-closing. More parties create more complexity and communications must often be carefully managed and coordinated by the M&A intermediary.

Purchase Agreement: In order to account for the typically reduced recourse against sellers, the purchase agreement in a Financially Distressed M&A Transaction often looks quite different from a purchase agreement for a financially healthy target.

Source: https://www.natlawreview.com/article/covid-19-distressed-ma-era-pandemic

Example Transactions

SealedBid’s Role in Distressed Transactions

The best way to decide if now is the best time to sell your business, is to speak with an M&A advisor. SealedBid is proud to have successfully served clients for over 25 years with M&A Advisory, Recapitalizations, Succession/Exit Planning, Family Transfers and Management/Partner Buy-outs. As a boutique firm, SealedBid engages in a limited number of projects at any given time to ensure we deliver the highest level of senior attention, expert advice and transaction experience to each client.

Our Transaction Professionals use a team approach and have completed many Distressed Transactions in the past. SealedBid uses an extremely Confidential approach in standard transactions and Accelerated Transactions that has led to great success. Clients can be assured they are working with a strong deal team that can support a Distressed Transaction from pre-marketing to marketing to Due Diligence to closing.

If you are interested in learning more about SealedBid, our services or our team, please do not hesitate to contact us at (952) 893-0232. SealedBid will work closely with you, your financial advisor, attorney, accountant and banker from the initial stages of pre-marketing through closing and post-closing.